The worlds of mixed martial arts and professional wrestling will join forces, with the UFC and WWE set to become part of the same company following a huge deal struck by the UFC’s parent company Endeavor.

The news comes with the announcement from Endeavor, which has signed a “definitive agreement” to create a brand new, publicly-listed company that will consist of both UFC and WWE. A statement from Endeavor stated that, “upon close, Endeavor will hold a 51% controlling interest in the new company and existing WWE shareholders will hold a 49% interest in the new company.”

“This is a rare opportunity to create a global live sports and entertainment pureplay built for where the industry is headed,” said CEO of Endeavor, Ari Emanuel.

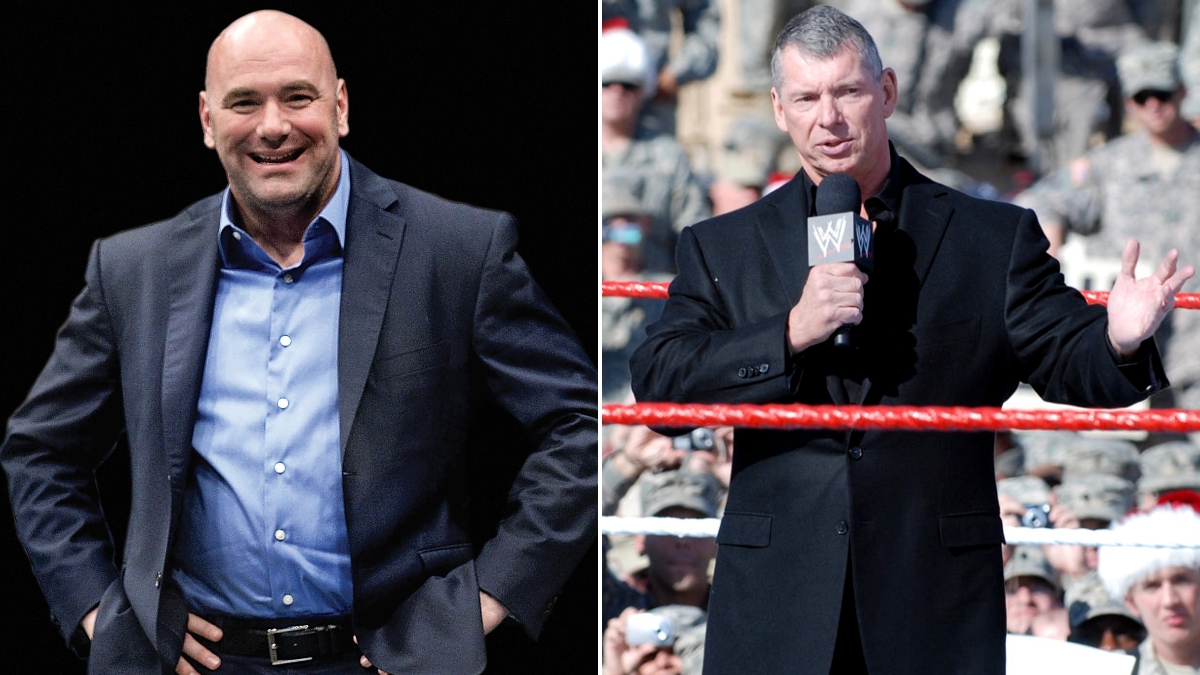

“For decades, Vince and his team have demonstrated an incredible track record of innovation and shareholder value creation, and we are confident that Endeavor can deliver significant additional value for shareholders by bringing UFC and WWE together.”

“Given the incredible work that Ari and Endeavor have done to grow the UFC brand – nearly doubling its revenue over the past seven years – and the immense success we’ve already had in partnering with their team on a number of ventures, I believe that this is without a doubt the best outcome for our shareholders and other stakeholders,” said Executive Chairman of WWE, Vince McMahon.

“Together, we will be a $21+ billion live sports and entertainment powerhouse with a collective fanbase of more than a billion people and an exciting growth opportunity. The new company will be well positioned to maximize the value of our combined media rights, enhance sponsorship monetization, develop new forms of content and pursue other strategic mergers and acquisitions to further bolster our strong stable of brands. I, along with the current WWE management team, look forward to working closely with Ari and the Endeavor and UFC teams to take the businesses to the next level.”

Under the newly-formed company, Emanuel will serve as CEO, with McMahon set to become president of the venture. Mark Shapiro will take on the COO role. UFC president Dana White will continue in his role, while his equivalent in WWE, Nick Khan, will do the same.

“This company has been on fire for the last seven years and now that we will be adding WWE to the portfolio,” said White.

“Vince is a savage in the wrestling space, Ari is a beast at what he does, and then add what we at the UFC bring to the table and there is no limit to what this company can accomplish in the next few years.”

Transaction details, per Endeavor press release:

The transaction values UFC at an enterprise value of $12.1 billion and WWE at an enterprise value of $9.3 billion. The transaction represents a contribution price of WWE of approximately $106 per share (before any post-closing dividend). Additionally, UFC and WWE will each contribute cash to the new company so that it holds approximately $150 million. At closing, Endeavor intends to sweep all excess cash at UFC, and shareholders of the new company (other than Endeavor) are expected to receive a post-closing dividend.

Under the terms of the transaction, existing WWE shareholders will roll all existing equity into the new entity that will be the parent company of UFC and WWE (“NewCo” until it is named at a later date) and intends to list on the New York Stock Exchange under the ticker symbol “TKO”. The listing of NewCo will expand the collective investor base to allow for broad market participation across Endeavor and NewCo.

The transaction has been unanimously approved by the Executive Committee of the Board of Directors of Endeavor and by the Board of Directors of WWE. The transaction is subject to the satisfaction of customary closing conditions, including receipt of required regulatory approvals. The transaction is expected to close in the second half of 2023.

This marks the successful conclusion of WWE’s strategic alternatives review process. WWE embarked on this process to take advantage of the company’s unique position in the entertainment ecosystem as well as the inflection point coming with its media rights renewals, both of which were widely recognized in the marketplace through this process.